Featured

Table of Contents

Don't wait to ask questions and clear up expectations prior to approving a placement. When you've located the appropriate remote treatment job, it's time to prepare your digital method for success. Creating a professional, effective, and client-centered teletherapy environment aids provide top notch treatment and construct strong therapeutic connections. Right here are the crucial elements to take into consideration: Get a reputable, high-speed web link (at the very least 10 Mbps), a computer or laptop computer that satisfies your telehealth system's needs, and a high-grade cam and microphone for clear video clip and audio.

Usage noise-reducing strategies and keep discretion by avoiding interruptions throughout sessions. Usage active listening, maintain eye get in touch with by looking at the electronic camera, and pay interest to your tone and body language.

Working from another location eliminates the requirement for a physical workplace, reducing prices associated to lease, utilities, and maintenance. You additionally save money and time on travelling, which can reduce tension and improve overall well-being. Remote treatment raises accessibility to look after clients in backwoods, with limited mobility, or facing various other obstacles to in-person treatment.

Actual Numbers Of Portable Practice

Functioning from another location can occasionally really feel separating, lacking in person interactions with colleagues and customers. Managing client emergencies or crises from a distance can be challenging. Telehealth requires clear methods, emergency situation calls, and experience with neighborhood resources to ensure client safety and security and appropriate care.

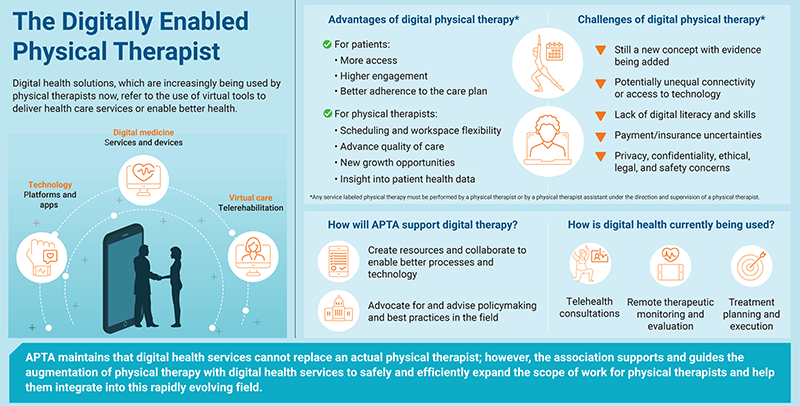

Remaining notified concerning altering telehealth guidelines and best techniques is essential. Each state has its own regulations and guidelines for teletherapy practice, including licensing requirements, educated permission, and insurance repayment. Staying on par with state-specific guidelines and acquiring essential authorizations is a continuous duty. To thrive lasting as a remote specialist, concentrate on expanding skillfully and adapting to the transforming telehealth setting.

Can Online Sessions Actually Work

A hybrid version can provide adaptability, minimize display tiredness, and permit an extra gradual change to completely remote job. Try different combinations of online and face-to-face sessions to find the right equilibrium for you and your customers. As you browse your remote treatment career, keep in mind to focus on self-care, established healthy and balanced borders, and seek support when needed.

Study consistently shows that remote treatment is as reliable as in-person therapy for common mental health and wellness conditions. As more clients experience the benefit and comfort of receiving care in the house, the acceptance and demand for remote solutions will continue to expand. Remote specialists can earn affordable salaries, with potential for greater revenues through field of expertise, private practice, and profession improvement.

The Future is Now Here

We recognize that it's handy to chat with an actual human when disputing web layout business, so we 'd like to set up a time to chat to ensure we're an excellent mesh. Please complete your info below so that a member of our group can help you obtain this procedure started.

Tax deductions can save freelance therapists money. If you don't know what qualifies as a write off, you'll miss out on out. That's because, also if you track your insurance deductible expenses, you need to maintain invoices handy in order to report them. In case of an audit, the IRS will certainly require invoices for your tax reductions.

There's a great deal of debate amongst local business owner (and their accounting professionals) about what comprises an organization meal. The Tax Cuts and Jobs Act (TCJA) of 2017 just additionally muddied the waters. The TCJA successfully eliminated tax obligation deductible home entertainment expenditures. Considering that meals were frequently lumped in with amusement expenses, this created a great deal of anxiety amongst company owner that typically deducted it.

Normally, this indicates a dining establishment with either takeout or take a seat service. Active ingredients for dish preparation, or food bought for anything apart from instant usage, do not qualify. To certify, a meal must be purchased during a service trip or shown a company associate. A lot more on business traveling deductions below.

Essential Topic Cluster: Virtual Mental Health Services

Find out more regarding subtracting service dishes. source If you travel for businessfor instance, to a seminar, or in order to provide a talk or facilitate a workshopyou can subtract most of the expenses. And you may even have the ability to squeeze in some vacationing while you're at it. What's the difference in between a vacation and a service trip? In order to qualify as company: Your journey should take you outside your tax obligation home.

You have to be away for longer than one job day. If you are away for 4 days, and you invest three of those days at a seminar, and the fourth day sightseeing and tour, it counts as an organization trip.

You need to be able to verify the trip was planned beforehand. The internal revenue service intends to avoid having company owner add specialist tasks to entertainment journeys in order to turn them into organization expenses at the last moment. Preparing a created itinerary and traveling strategy, and reserving transportation and accommodations well ahead of time, helps to show the trip was mainly business relevant.

When utilizing the gas mileage rate, you don't include any kind of various other expensessuch as oil changes or routine maintenance and repair work. The only extra automobile prices you can subtract are auto parking costs and tolls. If this is your very first year having your vehicle, you must determine your deduction utilizing the gas mileage price.

Why Office-Based Therapy is Going Obsolete

If you exercise in an office outside your home, the expense of rent is completely deductible. The price of energies (heat, water, electricity, web, phone) is likewise deductible.

Latest Posts

Nervous System Responses to Touch After Trauma

The Betrayal Factor

When Physical Affection Reveals Deeper Injuries: Why Trauma-Informed Sex Treatment Adjustments Every Little Thing